Expect a massive surge in U.S. oil exports this year

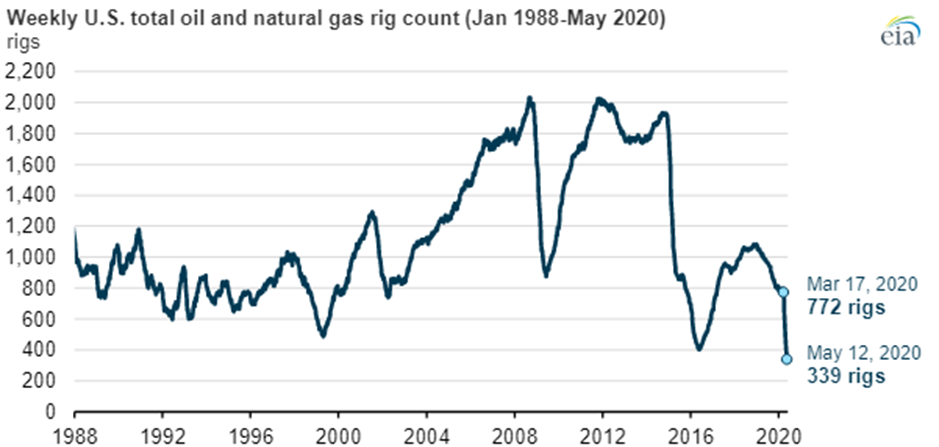

In May, 2020, the Energy Information Administration (EIA) reported that active U.S. oil and natural gas rigs had fallen to the lowest level on record. This was eight months before President Trump left office, but this was not caused by Trump’s energy policy.

The 2020 collapse in drilling was caused by the COVID pandemic. COVID slashed global oil demand. That demand destruction caused the price of oil to plummet. Low prices caused drillers to slash their investments in active rigs.

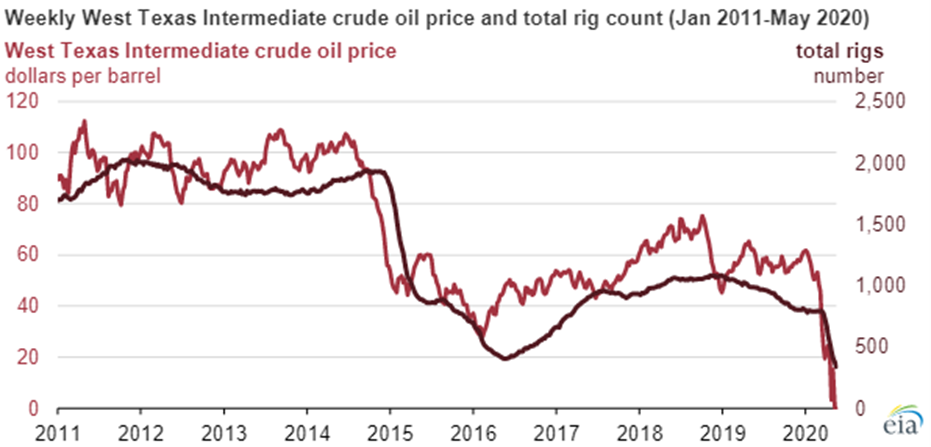

The global oil market is always all about demand, supply, and the market price that balances supply and demand. The following EIA graph shows the relationship between active drilling rigs and the price of West Texas Intermediate (WTI) crude oil from January 2011 through May 2020.

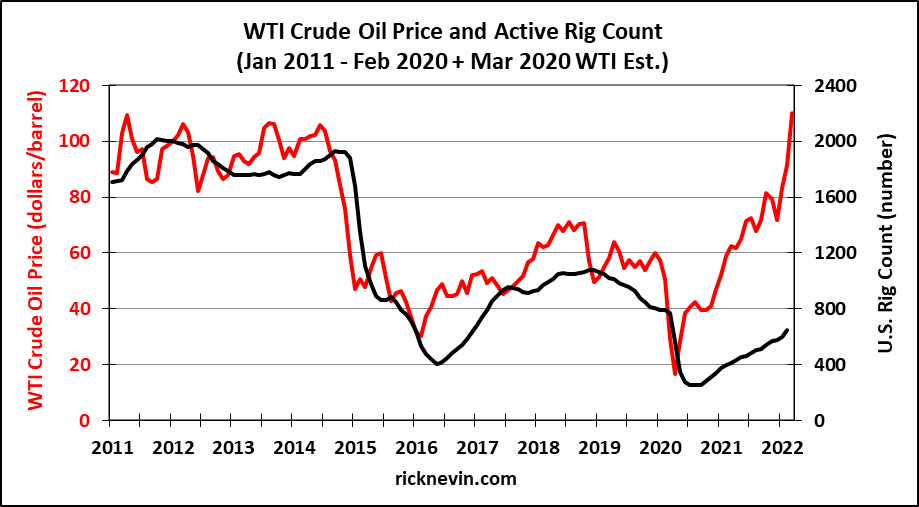

The EIA notes that changes in active oil rigs have historically followed changes in oil prices with a lag of four months. Updating the EIA graph with monthly data for active drilling rigs and WTI oil prices through February 2022, plus a guesstimate of $110/barrel in March, shows that the active rig count is set to rocket upward this year.

The monthly rig count bottomed out at 250 in September 2020. The weekly rig count rose to 650 by the end of February 2022, and 663 in the week ending March 11. If the price of oil remains above $100/barrel, then active rigs could approach 2000 later this year.

The rebound in drilling since September 2020 has been slowed by a backlog of wells that were drilled but uncompleted (DUCs). In normal times, EIA has observed a high correlation between rig counts and new-well counts with a two-month lag, but the 2020 oil price crash caused a surge in DUCs, as drillers delayed well completions until prices recovered. With the DUC backlog now largely cleared, the rig count should increase at a much faster rate.

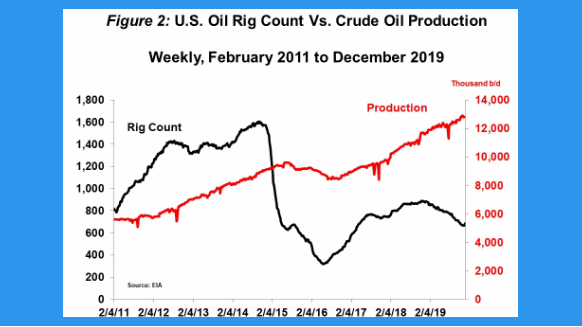

From 2011 through 2014, oil prices were close to $100/barrel and active rig counts were close to 2000. A return to that level of drilling activity this year would produce far more oil than it did a decade ago because shale oil innovations have steadily increased the amount of crude oil production associated with any specific level of drilling activity.

Clemente (Rigzone, 1-7-2020) explains: “The powerful combination of faster and better horizontal drilling and hydraulic fracturing has helped grow output even when the rig count falls (see Figure 2). … In 2013, 1,385 oil rigs were yielding 8 million b/d of crude. In 2019, however, 680 rigs were producing a whopping 12.8 million b/d.”

In other words, U.S. crude oil production increased by 4.8 million b/d (barrels/day) as oil prices fell from close to $100 in 2013 to about $60 in 2019. With oil prices back above $100/barrel, U.S. oil output could increase by another 4.8 million b/d.

The total amount of Russian oil exported to countries backing sanctions is 4.8 million b/d. If you are doubtful that the U.S. can rapidly replace all Russian oil exports to the West, then you are in the company of many analysts who have underestimated the impact of shale oil, as Clemente noted in 2020.

“we cannot really blame analysts for being so wrong about the shale revolution, a deficiency likely to continue on into the coming decade. … the industry has transformed global energy markets in ways never thought possible – not even by the oil and gas companies themselves. This helps explain why the IEA [International Energy Agency] forecasts that the U.S. will account for 85% of new global crude output and 35% of new natural gas through 2030. For finances, WTI prices sticking above $65 or $70 would be just the boost the shale industry needs. Ultimately, it will be a burgeoning U.S. export business that will mandate new output. (Clemente, 2020)

Some environmentalists will be horrified by surging U.S. oil production. They want to keep oil in the ground. I want to keep it in the ground in Russia. Many will be especially horrified by shale oil fracking. There are environmental risks associated with fracking. That is a good reason for sensible regulations that reduce risks, but not a good reason to ban fracking. There are also risks associated with vehicle travel, but that is not a good reason to shut down the Interstate Highway System.

Environmentalists should be consoled by the oil demand destruction caused by oil prices at $100/barrel. There will be significant temporary demand destruction as people drive less. There will also be substantial permanent oil demand destruction as consumers and businesses increase demand for more efficient vehicles.

We have already unleashed a lot of permanent oil demand destruction with transportation technology advances and associated fuel economy regulations enacted in the last 15 years. The U.S. weighted average miles per gallon (mpg) of new cars and light trucks rose from 19.3 in 2004 to 22.6 in 2010, 24.5 in 2015, and 25.7 in 2020. That’s a 33% increase from 2004-2020. We have also unleashed permanent oil demand destruction with heavy-duty truck fuel efficiency regulations, resulting in a 24% gain in fuel efficiency for new heavy duty trucks from 2011-2017. Older, less-efficient vehicles are retired from the vehicle stock every year and replaced by new more efficient vehicles, so ongoing efficiency gains for new vehicles ensure ongoing efficiency gains for the total vehicle stock. This U.S. oil demand destruction will increase the amount of U.S. oil available for export.

The rapid increase in electric vehicle (EV) sales will accelerate oil demand destruction. The IEA reports that EVs accounted for 2.5% of global car and light truck sales in 2019, 4.1% in 2020, and close to 9% in 2021. This is how to keep oil in the ground, with technologies that cause permanent oil demand destruction. Fracking bans and other attempts to suppress U.S. oil supply are pointless when other nations are anxious to provide that supply.

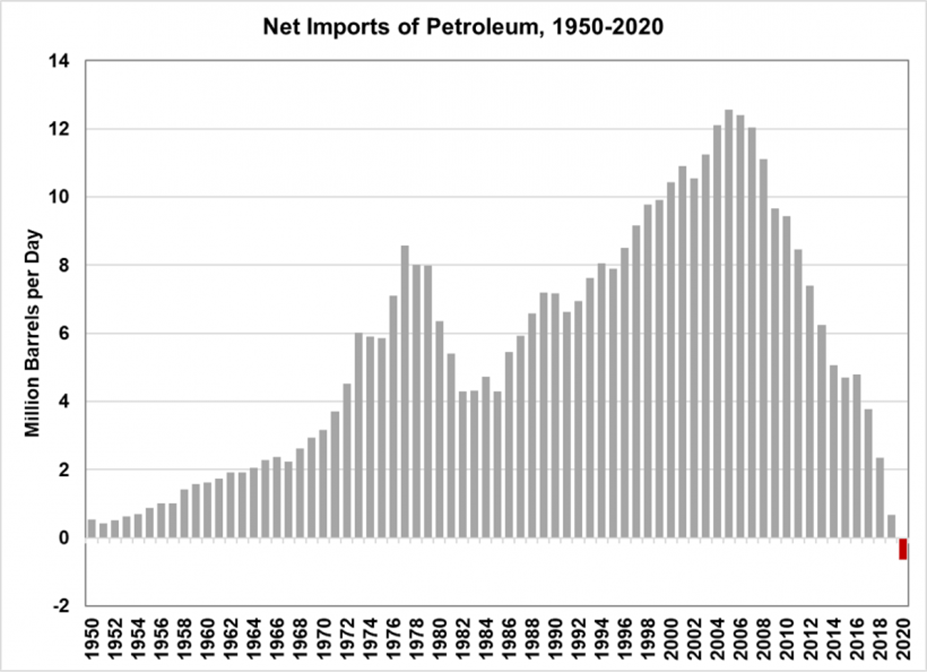

In 2020, the U.S. was a net petroleum exporter for the first time in at least 70 years. The U.S. was also a net petroleum exporter in the first half of 2021.

Oil prices above $100/barrel will accelerate both the near-term trend of rising U.S. crude oil production, and the long-term trend of oil demand destruction. This combination of supply and demand impacts will allow the U.S. to rapidly – and permanently – replace all Russian oil exports to the West.